Page 75 - MC14326 all pages

P. 75

The South African Insurance Industry Survey 2016 | 71

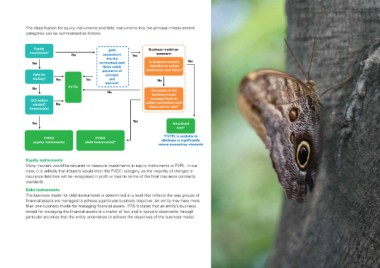

The classification for equity instruments and debt instruments into the principal measurement

categories can be summarised as follows:

Equity No SPPI Yes Business model as-

investment? assessment sessment

Yes

Yes Are the Is business model’s

contractual cash objective to collect

contractual cash flows?

flows solely

Held for Yes No payments of No

trading? FVTPL

principal Are assets in the

No and business model

managed both to

interest? collect contractual cash

flows and for sale?

No

OCI option No

elected?

(Irrevocable)

Yes Yes Amortised

cost*

FVOCI FVOCI

(equity instruments) (debt instruments)* *FVTPL is available to

eliminate or significantly

reduce accounting mismatch

Equity instruments

Many insurers would be required to measure investments in equity instruments at FVPL. In our

view, it is unlikely that insurers would elect the FVOCI category, as the majority of changes in

insurance liabilities will be recognised in profit or loss (in terms of the final insurance contracts

standard).

Debt instruments

The business model for debt instruments is determined at a level that reflects the way groups of

financial assets are managed to achieve a particular business objective. An entity may have more

than one business model for managing financial assets. IFRS 9 states that an entity’s business

model for managing the financial assets is a matter of fact and is typically observable through

particular activities that the entity undertakes to achieve the objectives of the business model.