Page 16 - MC14326 all pages

P. 16

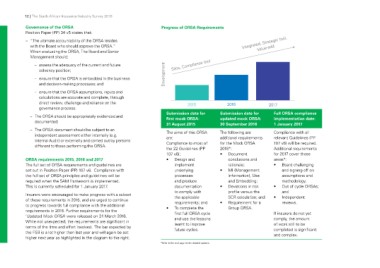

12 | The South African Insurance Industry Survey 2016 Progress of ORSA Requirements IntegrateVda,luSetr-aatdedgic tool,

Silos, Compliance tool

Governance of the ORSA Development

Position Paper (PP) 34 v5 states that:

2015 2016 2017

–– “The ultimate accountability of the ORSA resides

with the Board who should approve the ORSA.” Submission date for Submission date for Full ORSA compliance

When evaluating the ORSA, The Board and Senior first mock ORSA: updated mock ORSA: implementation date:

Management should: 31 August 2015 30 September 2016 1 January 2017

–– assess the adequacy of the current and future The aims of this ORSA The following are Compliance with all

solvency position; are: additional requirements relevant Guidelines (PP

Compliance to most of for the Mock ORSA 107 v6) will be required.

–– ensure that the ORSA is embedded in the business the 22 Guidelines (PP 2016*: Additional requirements

and decision-making processes; and 107 v6); • Document for 2017 cover these

• Design and areas*:

–– ensure that the ORSA assumptions, inputs and conclusions and • Board challenging

calculations are accurate and complete, through implement rationale;

direct review, challenge and reliance on the underlying • MI (Management and signing off on

governance process. processes Information), Use assumptions and

and produce and Embedding; methodology;

–– The ORSA should be appropriately evidenced and documentation • Deviations in risk • Out of cycle ORSAs;

documented. to comply with profile versus the and

the applicable SCR calculation; and • Independent

–– The ORSA document should be subject to an requirements; and • Requirement for a reviews.

independent assessment either internally (e.g. • To complete the Group ORSA.

Internal Audit) or externally and carried out by persons first full ORSA cycle If insurers do not yet

different to those performing the ORSA. and use the lessons comply, the amount

learnt to improve of work still to be

ORSA requirements 2015, 2016 and 2017 future cycles. completed is significant

The full set of ORSA requirements and guidelines are and complex.

set out in Position Paper (PP) 107 v6. Compliance with *Refer to the next page for the detailed updates.

the full set of ORSA principles and guidelines will be

required when the SAM framework is implemented.

This is currently scheduled for 1 January 2017.

Insurers were encouraged to make progress with a subset

of these requirements in 2015, and are urged to continue

to progress towards full compliance with the additional

requirements in 2016. Further requirements for the

‘Updated Mock ORSA’ were released on 31 March 2016.

While not unexpected, the requirements are significant in

terms of the time and effort involved. The bar expected by

the FSB is a lot higher than last year and will again be set

higher next year as highlighted in the diagram to the right.