Page 22 - MC14326 all pages

P. 22

18 | The South African Insurance Industry Survey 2016

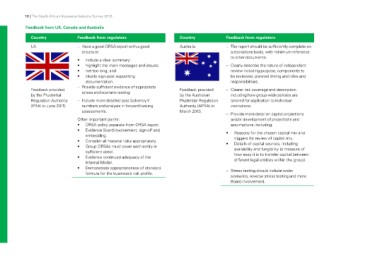

Feedback from UK, Canada and Australia

Country Feedback from regulators Country Feedback from regulators

UK Australia

–– Have a good ORSA report with a good –– The report should be sufficiently complete on

Feedback provided structure: Feedback provided a standalone basis, with minimum reference

by the Prudential by the Australian to other documents.

Regulation Authority • include a clear summary; Prudential Regulation

(PRA) in June 2015. • highlight the main messages and issues; Authority (APRA) in –– Clearly describe the nature of independent

• not too long; and March 2013. review including purpose, components to

• clearly sign-post supporting be reviewed, planned timing and roles and

responsibilities.

documentation.

–– Provide sufficient evidence of appropriate –– Clearer risk coverage and description

including how group-wide policies are

stress and scenario testing. tailored for application to individual

institutions.

–– Include more detailed post Solvency II

numbers and analysis in forward looking –– Provide more detail on capital projections

assessments. and/or development of projections and

assumptions, including:

Other important points:

• ORSA policy separate from ORSA report. • Reasons for the chosen capital mix and

• Evidence Board involvement, sign-off and triggers for review of capital mix.

embedding. • Details of capital sources, including

• Consider all material risks appropriately. availability and fungibility (a measure of

• Group ORSAs must cover each entity in how easy it is to transfer capital between

different legal entities within the group).

sufficient detail.

• Evidence continued adequacy of the –– Stress testing should include wider

scenarios, reverse stress testing and more

Internal Model. Board involvement.

• Demonstrate appropriateness of standard

formula for the business’s risk profile.