Page 139 - MC14326 all pages

P. 139

The South African Insurance Industry Survey 2016 | 135

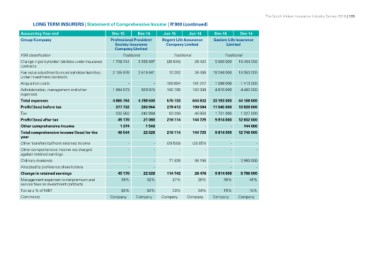

LONG TERM INSURERS | Statement of Comprehensive Income | R’000 (continued)

Accounting Year end Dec-15 Dec-14 Jun-15 Jun-14 Dec-15 Dec-14

Group/Company

Professional Provident Regent Life Assurance Sanlam Life Insurance

FSB classification Society Insurance Company Limited Limited

Change in policyholder liabilities under insurance Company Limited

contracts

Fair value adjustments on policyholder liabilities Traditional Traditional Traditional

under investment contracts 5 000 000 16 464 000

Acquisition costs 1 728 244 2 255 497 (36 646) 26 402

Administration, management and other

expenses 2 105 976 2 519 441 10 292 26 488 18 244 000 18 353 000

Total expenses

Profit/(loss) before tax - - 169 894 181 217 1 599 000 1 413 000

Tax 1 084 073 829 975 180 796 162 338 4 870 000 4 460 000

Profit/(loss) after tax

Other comprehensive income 4 865 794 4 789 500 575 133 644 832 33 193 000 44 168 000

Total comprehensive income/(loss) for the 377 732 263 944 279 412 190 584 11 545 000 13 929 000

year 332 562 242 864

Other transfers to/(from) retained income 45 170 21 080 63 298 45 859 1 731 000 1 327 000

Other comprehensive income not charged 1 374 1 548 216 114 144 725 9 814 000 12 602 000

against retained earnings 46 544 22 628

Ordinary dividends - - - 144 000

Allocated to preference shareholders 216 114 144 725 9 814 000 12 746 000

Change in retained earnings

Management expenses to net premium and - - (29 546) (20 051) - -

service fees on investment contracts ------

Tax as a % of NIBT

Comments - - 71 826 98 198 - 3 950 000

- - - - - -

45 170 22 628 9 814 000

38% 32% 114 742 26 476 38% 8 796 000

27% 26% 48%

88% 92% 23% 24% 15% 10%

Company Company Company Company Company Company