Page 135 - MC14326 all pages

P. 135

The South African Insurance Industry Survey 2016 | 131

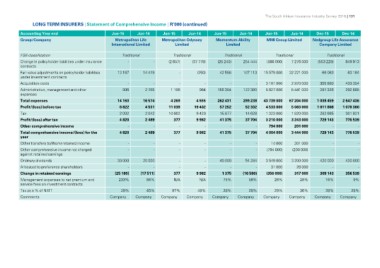

LONG TERM INSURERS | Statement of Comprehensive Income | R’000 (continued)

Accounting Year end Jun-15 Jun-14 Jun-15 Jun-14 Jun-15 Jun-14 Jun-15 Jun-14 Dec-15 Dec-14

Group/Company

Metropolitan Life Metropolitan Odyssey Momentum Ability MMI Group Limited Nedgroup Life Assurance

International Limited Limited Limited Company Limited

FSB classification Traditional Traditional Traditional Traditional Traditional

Change in policyholder liabilities under insurance

contracts - - (2 657) (37 778) (25 240) 254 444 (586 000) 7 276 000 (553 229) 849 913

Fair value adjustments on policyholder liabilities

under investment contracts 13 167 14 419 - (250) 42 586 107 113 15 579 000 32 221 000 66 063 63 184

Acquisition costs

Administration, management and other --- - - - 3 101 000 2 970 000 355 889 433 354

expenses 996 2 155 1 106

Total expenses 964 156 384 122 380 5 827 000 5 441 000 281 326 292 695

Profit/(loss) before tax

Tax 14 163 16 574 4 269 4 555 262 431 299 238 43 739 000 67 204 000 1 038 459 2 647 436

Profit/(loss) after tax 6 822 4 531 11 039 19 402 57 252 52 332 4 533 000 5 063 000 1 011 808 1 078 360

Other comprehensive income 2 002 2 042 10 662 15 877 14 628 1 323 000 1 820 000

Total comprehensive income/(loss) for the 4 820 2 489 9 420 41 375 37 704 3 210 000 3 243 000 282 665 301 821

year - - 377 9 982 - - 794 000 201 000 729 143 776 539

Other transfers to/(from) retained income 4 820 2 489 - 41 375 37 704 4 004 000 3 444 000

Other comprehensive income not charged - - -

against retained earnings 377 9 982 729 143 776 539

Ordinary dividends

Allocated to preference shareholders - - - - - - 14 000 301 000 - -

Change in retained earnings

Management expenses to net premium and - - - - - - (794 000) (200 000) - -

service fees on investment contracts

Tax as a % of NIBT 30 000 20 000 - - 40 000 54 284 3 549 000 3 200 000 420 000 420 000

Comments - -

- - - - 31 000 28 000 - -

(25 180) (17 511)

233% 84% 377 9 982 1 375 (16 580) (356 000) 317 000 309 143 356 539

N/A N/A 75% 58% 28% 28% 16% 9%

29% 45% 97% 49% 28% 28% 29% 36% 28% 28%

Company Company Company Company Company Company Company Company Company Company