Page 137 - MC14326 all pages

P. 137

The South African Insurance Industry Survey 2016 | 133

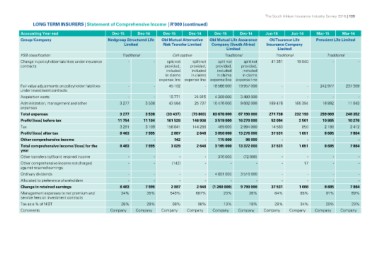

LONG TERM INSURERS | Statement of Comprehensive Income | R’000 (continued)

Accounting Year end Dec-15 Dec-14 Dec-15 Dec-14 Dec-15 Dec-14 Jun-15 Jun-14 Mar-15 Mar-14

Group/Company

Nedgroup Structured Life Old Mutual Alternative Old Mutual Life Assurance OUTsurance Life Prescient Life Limited

FSB classification Limited Risk Transfer Limited Company (South Africa) Insurance Company

Change in policyholder liabilities under insurance Limited

contracts Limited

Fair value adjustments on policyholder liabilities Traditional Cell captive Traditional Traditional Traditional

under investment contracts - -

Acquisition costs - split not split not split not split not 41 351 19 840 -

Administration, management and other provided, provided, provided, provided,

expenses included included included included

Total expenses in claims in claims in claims in claims

Profit/(loss) before tax expense line expense line expense line expense line

Tax

Profit/(loss) after tax -- 45 102 - 18 566 000 19 957 000 - - 242 977 237 309

Other comprehensive income

Total comprehensive income/(loss) for the - - 15 771 24 915 4 309 000 3 480 000 - - - -

year 3 277 3 538 43 584 25 737 10 476 000 9 602 000 189 476 185 394 16 892 11 043

Other transfers to/(from) retained income

Other comprehensive income not charged 3 277 3 538 (33 437) (73 803) 83 676 000 87 190 000 271 738 232 193 259 869 248 352

against retained earnings 11 754 11 104 161 528 146 936 3 519 000 16 270 000 52 094 2 501 10 865 10 276

Ordinary dividends 158 641 144 288 469 000 14 563 850 2 180 2 412

Allocated to preference shareholders 3 291 3 109 3 050 000 2 994 000 37 531 1 651 8 685 7 864

Change in retained earnings 8 463 7 995 2 887 2 648 115 000 13 276 000 - - - -

Management expenses to net premium and 142 - 3 165 000 37 531 1 651 8 685 7 864

service fees on investment contracts - - 96 000

Tax as a % of NIBT 8 463 7 995 3 029 2 648 13 372 000

Comments

- - - - 376 000 (72 000) ----

- - (142) - - - - 17 - -

- - - - 4 801 000 3 510 000 - - - -

- - - - - - - - - -

8 463 7 995 2 887 2 648 37 531 1 668 8 685 7 864

34% 35% 543% 687% (1 260 000) 9 790 000 64% 85% 91% 69%

23% 26%

28% 28% 98% 98% 13% 18% 28% 34% 20% 23%

Company Company Company Company Company Company Company Company Company Company