Page 145 - MC14326 all pages

P. 145

The South African Insurance Industry Survey 2016 | 141

this would result in more prudent application to the remaining capital base. All Africa Re (2014’s top performer) showing a decrease in investment income of

other companies surveyed have investment income percentages between 43%, to Scor showing a 93% increase in investment income. Africa Re invests

4%-6%. Investment income in total, for reinsurers surveyed, increased by approximately 20% of capital in equity instruments, a strategy that will show

2% year on year. However, there is significant volatility in these results from volatility in the short-term, but should show positive results over the long-term.

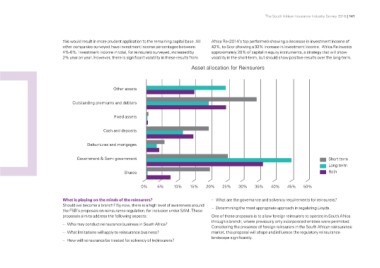

Asset allocation for Reinsurers

Other assets

Outstanding premiums and debtors

Fixed assets

Cash and deposits

Debuntures and mortgages

Government & Semi government Short term

Shares Long term

Both

0% 5% 10% 15% 20% 25% 30% 35% 40% 45% 50%

What is playing on the minds of the reinsurers? –– What are the governance and solvency requirements for reinsurers?

Should we become a branch? By now, there is a high level of awareness around

the FSB’s proposals on reinsurance regulation, for inclusion under SAM. These –– Determining the most appropriate approach in regulating Lloyds.

proposals aim to address the following aspects:

One of these proposals is to allow foreign reinsurers to operate in South Africa

–– Who may conduct reinsurance business in South Africa? through a branch, where previously only incorporated entities were permitted.

Considering the presence of foreign reinsurers in the South African reinsurance

–– What limitations will apply to reinsurance business? market, this proposal will shape and influence the regulatory reinsurance

landscape significantly.

–– How will reinsurance be treated for solvency of (re)insurers?