Page 28 - MC14326 all pages

P. 28

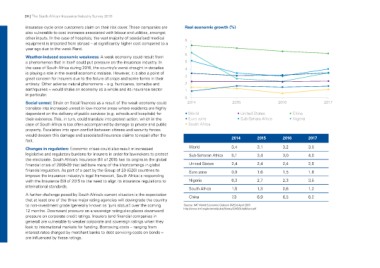

24 | The South African Insurance Industry Survey 2016 Real economic growth (%)

insurance cycle once customers claim on their risk cover. These companies are 2014 2015 2016 2017

also vulnerable to cost increases associated with labour and utilities, amongst

other inputs. In the case of hospitals, the vast majority of specialised medical • World • United States • China

equipment is imported from abroad – at significantly higher cost compared to a • Euro zone • Sub-Sahara Africa • Nigeria

year ago due to the weak Rand. • South Africa

Weather-induced economic weakness: A weak economy could result from 2014 2015 2016 2017

a phenomenon that in itself could put pressure on the insurance industry. In 3,5

the case of South Africa during 2016, the country’s worst drought in decades World 3,4 3,1 3,2 4,0

is playing a role in the overall economic malaise. However, it is also a point of 2,5

great concern for insurers due to the failure of crops and some farms in their Sub-Saharan Africa 5,1 3,4 3,0 1,6

entirety. Other adverse natural phenomena – e.g. hurricanes, tornados and 3,5

earthquakes – would shake an economy as a whole and its insurance sector United States 2,4 2,4 2,4 1,2

in particular. 6,2

Euro zone 0,9 1,6 1,5

Social unrest: Strain on fiscal finances as a result of the weak economy could

translate into increased unrest in low-income areas where residents are highly Nigeria 6,3 2,7 2,3

dependent on the delivery of public services (e.g. schools and hospitals) for

their existence. This, in turn, could translate into protest action, which in the South Africa 1,5 1,3 0,6

case of South Africa is too often accompanied by damage to private and public

property. Escalation into open conflict between citizens and security forces China 7,3 6,9 6,5

would deepen this damage and associated insurance claims to repair after the

fact. Source: IMF World Economic Outlook (WEO) April 2016

http://www.imf.org/external/pubs/ft/weo/2016/01/pdf/text.pdf

Changes in regulation: Economic crises could also result in increased

legislative and regulatory burdens for insurers in order for lawmakers to protect

the electorate. South Africa’s Insurance Bill of 2015 has its origins in the global

financial crisis of 2008-09 that laid bare many of the shortcomings in global

financial regulation. As part of a pact by the Group of 20 (G20) countries to

improve the insurance industry’s legal framework, South Africa is responding

with the Insurance Bill of 2015 to the need to align its insurance regulations to

international standards.

A further challenge posed by South Africa’s current situation is the expectation

that at least one of the three major rating agencies will downgrade the country

to non-investment grade (generally known as ‘junk status’) over the coming

12 months. Downward pressure on a sovereign rating also places downward

pressure on corporate credit ratings. Insurers (and financial companies in

general) are vulnerable to weaker corporate and sovereign ratings when they

look to international markets for funding. Borrowing costs – ranging from

interest rates charged by merchant banks to debt servicing costs on bonds –

are influenced by these ratings.