Page 133 - MC14326 all pages

P. 133

The South African Insurance Industry Survey 2016 | 129

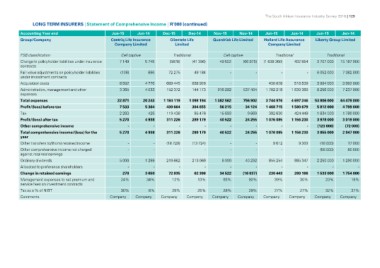

LONG TERM INSURERS | Statement of Comprehensive Income | R’000 (continued)

Accounting Year end Jun-15 Jun-14 Dec-15 Dec-14 Nov-15 Nov-14 Jun-15 Jun-14 Jun-15 Jun-14

Group/Company

Centriq Life Insurance Clientele Life Guardrisk Life Limited Hollard Life Assurance Liberty Group Limited

Company Limited Limited Company Limited

FSB classification Cell captive Traditional Cell captive Traditional Traditional

Change in policyholder liabilities under insurance 3 707 000 15 187 000

contracts 7 149 5 745 (5878) (41 396) 49 502 (66 975) (1 638 360) 432 854

Fair value adjustments on policyholder liabilities

under investment contracts (138) 886 72 275 49 184 - - - - 6 052 000 7 382 000

Acquisition costs

Administration, management and other 6 582 4 776 689 445 658 926 - - 430 028 516 539 3 994 000 3 992 000

expenses 3 365 4 033 152 372 144 173 916 282 537 404 1 702 218 1 630 360 8 256 000 7 237 000

Total expenses

Profit/(loss) before tax 22 871 20 243 1 184 119 1 098 194 1 382 562 756 902 3 744 976 4 697 246 53 806 000 64 479 000

Tax 7 533 5 364 430 664 384 655 56 215 34 124 1 468 715 1 580 679 5 812 000 4 799 000

Profit/(loss) after tax 2 263 426 119 438 95 476 15 693 9 869 1 834 000 1 780 000

Other comprehensive income 5 270 4 938 311 226 289 179 40 522 24 255 392 630 424 449 3 978 000 3 019 000

Total comprehensive income/(loss) for the - - - - - - 1 076 085 1 156 230 (123 000) (72 000)

year 5 270 4 938 311 226 289 179 40 522 24 255 3 855 000 2 947 000

Other transfers to/(from) retained income - -

Other comprehensive income not charged 1 076 085 1 156 230

against retained earnings

Ordinary dividends - - (18 729) (13 724) - - 9 612 9 303 (16 000) 17 000

Allocated to preference shareholders

Change in retained earnings - - - - - - - - (56 000) 80 000

Management expenses to net premium and

service fees on investment contracts 5 000 1 288 219 662 213 069 6 000 40 292 855 254 885 347 2 250 000 1 290 000

Tax as a % of NIBT - - - - - - - - - -

Comments

270 3 650 72 835 62 386 34 522 (16 037) 230 443 280 186 1 533 000 1 754 000

24% 34% 12% 13% 93% 92% 39% 30% 23% 18%

30% 8% 28% 25% 28% 29% 27% 27% 32% 37%

Company Company Company Company Company Company Company Company Company Company