Page 63 - MC14326 all pages

P. 63

The South African Insurance Industry Survey 2016 | 59

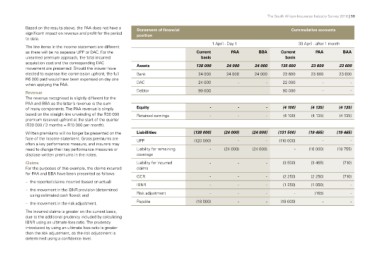

Based on the results above, the PAA does not have a Statement of financial Cummulative accounts

significant impact on revenue and profit for the period position

to date. 1 April - Day 1 30 April - after 1 month

Assets

The line items in the income statement are different Bank Current PAA BBA Current PAA BAA

as there will be no separate UPP or DAC. For the DAC basis basis

unearned premium approach, the total incurred Debtor 24 000

acquisition cost and the corresponding DAC 138 000 24 000 24 000 135 600 23 600 23 600

movement are presented. Should the insurer have Equity

elected to expense the commission upfront, the full Retained earnings 24 000 24 000 - 23 600 23 600 23 600

R6 000 paid would have been expensed on day one

when applying the PAA. Liabillities 24 000 - 22 000 - -

UPP

Revenue Liability for remaining 90 000 90 000 - -

The revenue recognised is slightly different for the coverage

PAA and BBA as the latter’s revenue is the sum Liability for incurred - - - (4 100) (4 135) (4 135)

of many components. The PAA revenue is simply claims - - - (4 100) (4 135) (4 135)

based on the straight-line unwinding of the R30 000 OCR

premium received upfront at the start of the quarter IBNR (138 000) (24 000) (24 000) (131 500) (19 465) (19 465)

(R30 000 / 3 months = R10 000 per month). Risk adjustment (120 000) - - (110 000) - -

Payable

Written premiums will no longer be presented on the - (24 000) (24 000) - (16 000) (18 755)

face of the income statement. Gross premiums are

often a key performance measure, and insurers may - - - (3 500) (3 465) (710)

need to change their key performance measures or

disclose written premiums in the notes. - - - (2 250) (2 250) (710)

- - - (1 250) (1 050) -

Claims - - - -

For the purposes of this example, the claims incurred (18 000) - - - (165) -

for PAA and BBA have been presented as follows: (18 000) -

–– the reported claims incurred (based on actual)

–– the movement in the IBNR provision (determined

using estimated cash flows); and

–– the movement in the risk adjustment.

The incurred claims is greater on the current basis,

due to the additional prudency included by calculating

IBNR using an ultimate loss ratio. The prudency

introduced by using an ultimate loss ratio is greater

than the risk adjustment, as the risk adjustment is

determined using a confidence level.