Page 64 - MC14326 all pages

P. 64

60 | The South African Insurance Industry Survey 2016

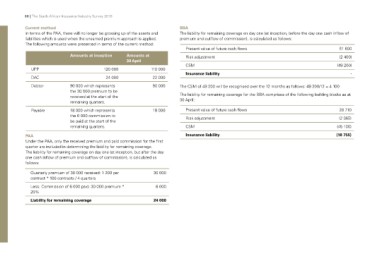

Current method BBA

In terms of the PAA, there will no longer be grossing up of the assets and The liability for remaining coverage on day one (at inception, before the day one cash inflow of

liabilities which is used when the unearned premium approach is applied. premium and outflow of commission), is calculated as follows:

The following amounts were presented in terms of the current method:

Present value of future cash flows 51 600

UPP Amounts at inception Amounts at Risk adjustment (2 400)

DAC 30 April CSM (49 200)

Debtor 120 000 Insurance liability

110 000 -

Payable 24 000 22 000

90 000 The CSM of 49 200 will be recognised over the 12 months as follows: 49 200/12 = 4 100

90 000 which represents

the 30 000 premium to be 18 000 The liability for remaining coverage for the BBA comprises of the following building blocks as at

received at the start of the 30 April:

remaining quarters.

Present value of future cash flows 28 710

18 000 which represents Risk adjustment (2 365)

the 6 000 commission to CSM (45 100)

be paid at the start of the Insurance liability (18 755)

remaining quarters.

PAA

Under the PAA, only the received premium and paid commission for the first

quarter are included in determining the liability for remaining coverage.

The liability for remaining coverage on day one (at inception, but after the day

one cash inflow of premium and outflow of commission), is calculated as

follows:

Quarterly premium of 30 000 received: 1 200 per 30 000

contract * 100 contracts / 4 quarters 6 000

Less: Commission of 6 000 paid: 30 000 premium * 24 000

20%

Liability for remaining coverage