Page 128 - MC14326 all pages

P. 128

124 | The South African Insurance Industry Survey 2016

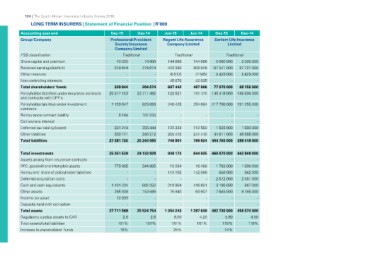

LONG TERM INSURERS | Statement of Financial Position | R’000

Accounting year end Dec-15 Dec-14 Jun-15 Jun-14 Dec-15 Dec-14

Group/Company

Professional Provident Regent Life Assurance Sanlam Life Insurance

FSB classification Society Insurance Company Limited Limited

Share capital and premium Company Limited

Retained earnings/(deficit)

Other reserves Traditional Traditional Traditional

Non-controlling interests 5 000 000 5 000 000

Total shareholders' funds 10 000 10 000 144 688 144 688 67 541 000 57 727 000

Policyholder liabilities under insurance contracts 5 429 000 5 429 000

and contracts with DPF's 319 844 274 674 423 390 308 648

Policyholder labilities under investment --

contracts -- (6 512) (7 565) 77 970 000 68 156 000

Reinsurance contract liability 140 418 000 148 804 000

Cell owners interest -- 45 876 42 035

Deferred tax liability/(asset)

Other liabilities 329 844 284 674 607 442 487 806

Total liabilities

25 577 153 23 711 492 122 627 191 170

1 139 647 825 699 246 425 254 684 217 796 000 191 255 000

6 184 107 233 - - - -

- - - - - -

122 334 112 560 1 635 000 1 693 000

331 214 355 444 255 415 241 410 44 911 000 46 666 000

333 711 240 212 746 801 799 824 404 760 000 388 418 000

27 381 725 25 240 080

Total investments 25 251 529 24 133 928 938 173 644 835 466 870 000 442 849 000

Assets arising from insurance contracts - - - - - -

PPE; goodwill and intangible assets

Reinsurers' share of policyholder liabilities 779 965 544 885 10 084 18 498 1 703 000 1 690 000

Deferred acquisition costs - - 110 192 142 089 650 000 642 000

Cash and cash equivalents - -

Other assets - - 2 672 000 2 561 000

Income tax asset 1 401 234 692 352 219 954 418 601 3 190 000 647 000

Deposits held with cell option 265 908 153 589 7 645 000

Total assets 12 933 75 840 63 607 8 185 000

Regulatory surplus assets to CAR - - - - - -

Total assets/total liabilities - - - - -

Increase in shareholders' funds 27 711 569 25 524 754 482 730 000

2,6 2,6 1 354 243 1 287 630 5,80 456 574 000

101% 8,00 4,20 119% 4,50

101% 14%

16% 181% 161% 118%

25%