Page 36 - MC14326 all pages

P. 36

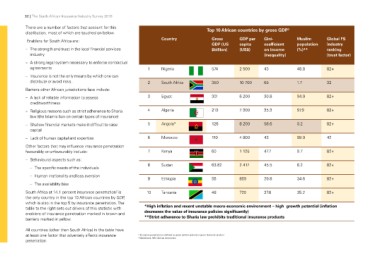

32 | The South African Insurance Industry Survey 2016 Top 10 African countries by gross GDP3

There are a number of factors that account for this Country Gross GDP per Gini- Muslim Global FS

distribution, most of which are touched on below. GDP (US capita coefficient population industry

$billion) (US$) on income (%)** ranking

Enablers for South Africa are: (inequality) (trust factor)

–– The strength and trust in the local financial services 1 Nigeria 574 2 500 43 48.8 82+

industry

2 South Africa 350 10 700 65 1.7 32

–– A strong legal system necessary to enforce contractual

agreements 3 Egypt 301 6 200 30.8 94.9 82+

–– Insurance is not the only means by which one can 4 Algeria 213 7 300 35.3 97.9 82+

distribute or avoid risks.

5 Angola* 126 8 200 58.6 0.2 82+

Barriers other African jurisdictions face include:

6 Morocco 110 4 800 43 99.9 42

–– A lack of reliable information to assess

creditworthiness 7 Kenya 60 1 125 47.7 9.7 82+

–– Religious reasons such as strict adherence to Sharia 8 Sudan 63.82 2 417 45.5 6.2 82+

law (the Islamic ban on certain types of insurance)

9 Ethiopia 55 859 29.8 34.6 82+

–– Shallow financial markets make it difficult to raise

capital 10 Tanzania 48 720 37.6 35.2 82+

–– Lack of human capital and expertise *High inflation and recent unstable macro-economic environment – high growth potential (inflation

decreases the value of insurance policies significantly)

Other factors that may influence insurance penetration **Strict adherence to Sharia law prohibits traditional insurance products

favourably or unfavourably include:

2 Insurance penetration is defined as gross written premium / gross domestic product

–– Behavioural aspects such as: 3 World bank, NKC African economics

–– The specific needs of the individuals

–– Human irrationality and loss aversion

–– The availability bias

South Africa at 14.1 percent insurance penetration2 is

the only country in the top 10 African countries by GDP,

which is also in the top 5 by insurance penetration. The

table to the right sets out drivers of this statistic with

enablers of insurance penetration marked in brown and

barriers marked in yellow.

All countries (other than South Africa) in the table have

at least one factor that adversely affects insurance

penetration.