Page 101 - MC14326 all pages

P. 101

The South African Insurance Industry Survey 2016 | 97

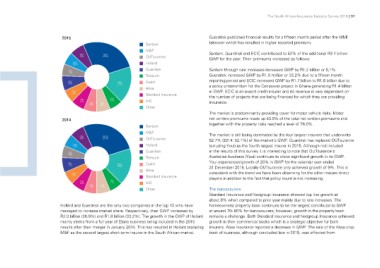

2015 Guardrisk published financial results for a fifteen month period after the MMI

takeover which has resulted in higher reported premium.

11% 24% Santam

10% M&F Santam, Guardrisk and ECIC contributed to 52% of the additional R9.1 billion

7% OUTsurance GWP for the year. Their premiums increased as follows:

Hollard

8% 21% Guardrisk Santam through rate increases increased GWP by R1.2 billion or 6,1%.

6% Telesure Guardrisk increased GWP by R1.8 million or 33.2% due to a fifteen month

3% 4% Zurich reporting period and ECIC increased GWP by R1.7 billion to R1.8 billion due to

2% Absa a policy underwritten for the Cenpower project in Ghana generating R1.4 billion

4% Standard Insurance in GWP. ECIC is an export credit insurer and its revenue is very dependent on

AIG the number of projects that are being financed for which they are providing

2014 Other insurance.

9% 25% Santam The market is predominantly providing cover for motor vehicle risks. Motor

11% M&F net written premiums made up 43.9% of the total net written premiums and

8% OUTsurance together with the property risks reached a level of 76.0%.

Hollard

7% 18% Guardrisk The market is still being dominated by the four largest insurers that underwrite

7% Telesure 52.7% (2014: 52.1%) of the market’s GWP. Guardrisk has replaced OUTsurance

3% 6% Zurich (exluding Youi) as the fourth largest insurer in 2015. Although not included

2% Absa in the results of this survey it is interesting to note that OUTsurance’s

4% Standard Insurance Australian business (Youi) continues to show significant growth in its GWP.

AIG Youi experienced growth of 28% in GWP for the calendar year ended

Other 31 December 2015. Locally OUTsurance only achieved growth of 9%. This is

consistent with the trend we have been observing for the other mature direct

Hollard and Guardrisk are the only two companies in the top 10 who have players in addition to the fact that policy count is not increasing.

managed to increase market share. Respectively, their GWP increased by

R2.0 billion (26.9%) and R1.8 billion (33.2%). The growth in the GWP of Hollard The bancassurers

mainly stems from a full year of Etana business being included in the 2015 Standard Insurance and Nedgroup Insurance showed top line growth at

results after their merger in January 2014. This has resulted in Hollard replacing about 8% when compared to prior year mainly due to rate increases. The

M&F as the second largest short-term insurer in the South African market. homeowners/ property book continues to be the largest contributor to GWP

at around 70- 80% for bancassurers, however, growth in the property book

remains a challenge. Both Standard Insurance and Nedgroup Insurance achieved

growth in their commercial books which is a strategic objective for both

insurers. Absa Insurance reported a decrease in GWP. The sale of the Absa crop

book of business, although concluded late in 2015, was effected from