Page 105 - MC14326 all pages

P. 105

The South African Insurance Industry Survey 2016 | 101

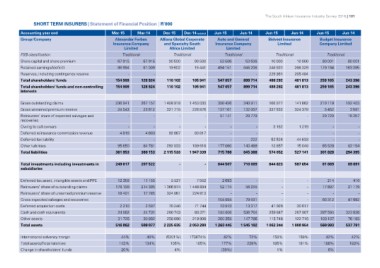

SHORT TERM INSURERS | Statement of Financial Position | R’000

Accounting year end Mar-15 Mar-14 Dec-15 Dec-14 restated Jun-15 Jun-14 Jun-15 Jun-14 Jun-15 Jun-14

Group/Company

Alexander Forbes Allianz Global Corporate Auto and General Bidvest Insurance Budget Insurance

FSB classification Insurance Company and Specialty South Insurance Company Limited Company Limited

Share capital and share premium Africa Limited

Retained earnings/(deficit) Limited Limited

Reserves, including contingency reserve

Total shareholders' funds Traditional Traditional Traditional Traditional Traditional

Total shareholders' funds and non-controlling

interests 67 915 67 915 90 500 90 500 53 506 53 506 10 000 10 000 80 001 80 001

86 994 61 009 19 602 15 441 494 151 846 208 248 931 266 329 179 164 163 395

-- -- -- 229 361 205 484 --

154 909 128 924 110 102 105 941 547 657 899 714 488 292 481 813 259 165 243 396

154 909 128 924 110 102 105 941 547 657 899 714 488 292 481 813 259 165 243 396

Gross outstanding claims 236 941 267 157 1 408 918 1 450 030 350 426 340 911 166 977 141 862 210 119 192 403

Gross unearned premium reserve 24 543 23 612 321 715 226 876 137 161 132 007 337 532 324 379 5 452 3 581

Reinsurers' share of expected salvages and - - - -

recoveries 51 141 28 779 - - 20 729 16 257

Owing to cell owners - - - -

Deferred reinsurance commission revenue 4 819 4 603 92 867 80 817 - - 3 162 1 219 - -

Deferred tax liability - - - - - -

Other liabilities - - - - - 222 - -

Total liabilities 95 650 84 781 292 033 189 616 177 060 143 469 52 524 44 633 65 528 82 154

361 953 380 153 2 115 533 1 947 339 715 788 645 388 13 857 15 048 301 828 294 395

574 052 527 141

Total investments including investments in 249 017 207 522 - - 644 507 710 009 644 823 587 654 81 869 69 691

subsidiaries

Deferred tax asset, intangible assets and PPE 12 358 11 155 5 527 7 552 2 693 - - - 214 410

Reinsurers' share of outstanding claims 178 199 214 395 1 366 974 1 448 894 52 174 58 255 - - 17 897 21 179

Reinsurers' share of unearned premium reserve - -

Gross expected salvages and recoveries 18 491 17 785 324 061 224 813 - - - - - -

Deferred acquisition costs - - - - 104 994 79 031 41 928 30 617 60 312 47 682

Cash and cash equivalents 13 317 259 847 267 967

Other assets 2 210 2 597 70 240 71 744 13 913 536 704 115 746 122 716 - -

Total assets 24 862 24 731 200 743 80 371 184 806 147 786 1 062 344 1 008 954 297 594 322 636

31 725 30 892 258 090 219 906 260 358 1 545 102 103 107

516 862 509 077 2 225 635 2 053 280 1 263 445 560 993 76 193

537 791

International solvency margin 44% 40% (5201%) 173674% 42% 72% 158% 159% 42% 42%

Total assets/Total liabilities 143% 134% 105% 105% 177% 239% 185% 191% 186% 183%

Change in shareholders' funds 4% (39%)

20% 1% 6%