Page 104 - MC14326 all pages

P. 104

100 | The South African Insurance Industry Survey 2016

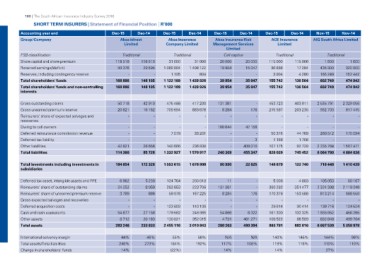

SHORT TERM INSURERS | Statement of Financial Position | R’000

Accounting year end Dec-15 Dec-14 Dec-15 Dec-14 Dec-15 Dec-14 Dec-15 Dec-14 Nov-15 Nov-14

Group/Company

Absa idirect Absa Insurance Absa Insurance Risk ACE Insurance AIG South Africa Limited

Limited Company Limited Management Services Limited

Limited

FSB classification Traditional Traditional Cell captive Traditional Traditional

Share capital and share premium

Retained earnings/(deficit) 118 510 118 510 31 000 31 000 20 000 20 000 115 000 115 000 1 600 1 600

Reserves, including contingency reserve

Total shareholders' funds 50 376 29 595 1 089 994 1 408 122 19 954 15 047 36 838 17 284 435 900 320 900

Total shareholders' funds and non-controlling

interests -- 1 195 804 -- 3 904 4 280 165 249 152 442

168 886 148 105 1 122 189 1 439 926 39 954 35 047 155 742 136 564 602 749 474 942

168 886 148 105 1 122 189 1 439 926 39 954 35 047 155 742 136 564 602 749 474 942

Gross outstanding claims 50 718 42 910 475 488 417 200 131 381 - 453 723 403 011 2 535 791 2 329 056

Gross unearned premium reserve 20 821 16 162 709 694 883 678 8 284 176 215 597 203 235 932 703 817 415

Reinsurers' share of expected salvages and - - -

recoveries - - - - - - -

Owing to cell owners 100 644 - -

Deferred reinsurance commission revenue - - - - - 47 158 - - 260 512 170 094

Deferred tax liability - - 7 079 33 201 - - 50 376 44 769

Other liabilities - - - 3 - -

Total liabilities 42 821 26 656 - - 1 168 1 708 2 335 784 1 567 471

114 360 85 728 140 666 236 838 240 309 408 010 107 175 92 729 6 064 790 4 884 036

1 332 927 1 570 917 455 347 828 039 745 452

Total investments including investments in 184 654 172 328 1 553 615 1 678 808 80 990 22 625 148 679 122 740 716 448 1 410 439

subsidiaries

Deferred tax asset, intangible assets and PPE 6 962 5 239 124 764 200 018 11 - 5 006 4 883 105 053 80 167

Reinsurers' share of outstanding claims 24 252 8 059 283 653 223 706 131 381 - 360 282 351 477 2 324 308 2 119 249

Reinsurers' share of unearned premium reserve 167 225 176 170 378 153 588

Gross expected salvages and recoveries 3 789 886 59 078 8 284 - 813 214 668 550

Deferred acquisition costs - - - - - - - - - -

Cash and cash equivalents - - 140 106 - 6 322 29 614 30 414

Other assets 123 603 248 965 461 271 161 300 132 325 139 716 124 524

Total assets 54 877 27 158 179 582 352 015 54 866 490 394 108 522 86 589 1 935 952 456 265

8 712 20 163 130 821 3 010 843 4 731 983 781 882 016 499 784

233 833 2 455 116 632 848 5 358 978

283 246 280 263 6 667 539

International solvency margin 44% 46% 55% 56% N/A N/A 140% 145% 144% 96%

Total assets/Total liabilities 248% 273% 184% 192% 117% 108% 119% 118% 110% 110%

Change in shareholders' funds (22%)

14% 14% 14% 27%