Page 119 - MC14326 all pages

P. 119

The South African Insurance Industry Survey 2016 | 115

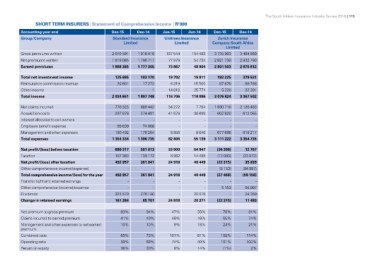

SHORT TERM INSURERS | Statement of Comprehensive Income | R’000

Accounting year end Dec-15 Dec-14 Jun-15 Jun-14 Dec-15 Dec-14

Group/Company

Standard Insurance Unitrans Insurance Zurich Insurance

Limited Limited Company South Africa

Limited

Gross premiums written 2 070 591 1 918 416 167 544 154 483 3 735 903 3 484 869

Net premiums written 1 919 085 1 796 717 77 979 54 734

Earned premiums 1 888 365 1 777 305 73 867 48 904 2 821 730 2 832 790

2 801 503 2 875 812

Total net investment income 125 685 103 170 19 702 19 911 182 225 379 531

Reinsurance commission revenue 20 601 17 272 8 319 15 500 87 876 89 768

Other income - 1 25 771 5 220 22 391

Total income 14 818 110 086

2 034 651 1 897 748 116 706 3 076 824 3 367 502

Net claims incurred 776 325 869 442 34 272 7 794 1 830 716 2 126 463

Acquisition costs 297 878 274 481 41 678 38 699 602 820 612 055

Interest allocated to cell owners - -

Employee benefit expense - - - - - -

Management and other expenses 99 639 74 608 - - 677 686 616 217

Total expenses 180 492 178 204 6 856 8 646

1 354 334 1 396 735 82 806 55 139 3 111 222 3 354 735

Net profit/(loss) before taxation 680 317 501 013 33 900 54 947 (34 398) 12 767

Taxation 187 360 139 172 8 982 14 498 (12 083) (23 072)

Net profit/(loss) after taxation 492 957 361 841 40 449 (22 315)

Other comprehensive income/(expense) 24 918 35 839

Total comprehensive income/(loss) for the year - - - - (5 153) (94 997)

Transfer to/(from) retained earnings 492 957 361 841 40 449 (27 468) (59 158)

Other comprehensive (income)/expense 24 918

Dividends - - - - - -

Change in retained earnings - - - - 5 153 94 997

331 573 276 140 - 20 078 24 359

161 384 85 701 20 371 - 11 480

24 918 (22 315)

Net premium to gross premium 93% 94% 47% 35% 76% 81%

Claims incurred to earned premium 41% 49% 46% 16% 65% 74%

Management and other expenses to net earned 10% 10% 18% 24% 21%

premium 9%

Combined ratio 65% 73% 81% 108% 114%

Operating ratio 59% 68% 101% 40% 101% 100%

Return on equity 36% 30% 74% 14%

8% (1%) 2%