Page 114 - MC14326 all pages

P. 114

110 | The South African Insurance Industry Survey 2016

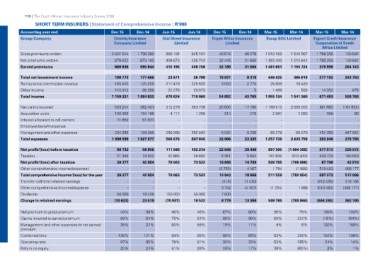

SHORT TERM INSURERS | Statement of Comprehensive Income | R’000

Accounting year end Dec-15 Dec-14 Jun-15 Jun-14 Dec-15 Dec-14 Mar-15 Mar-14 Mar-15 Mar-14

Group/Company

Centriq Insurance Dial Direct Insurance Enpet Africa Insurance Escap SOC Limited Export Credit Insurance

Company Limited Limited Limited Corporation of South

Africa Limited

Gross premiums written 2 031 544 1 756 380 900 192 945 161 48 616 46 278 1 618 189 1 540 567 1 788 350 130 642

Net premiums written 879 032 873 103 409 873 436 742 32 445 31 650 1 383 400 1 214 844

Earned premiums 669 836 695 844 415 196 436 758 32 188 31 666 1 481 601 1 155 724 1 788 350 130 642

379 999 264 143

Total net investment income 198 773 177 466 23 671 26 799 18 831 9 319 446 425 365 619 277 102 243 750

Reinsurance commission revenue 180 410 125 255 217 479 225 630 3 033 2 775 25 609 19 428 - -

Other income 110 312 - 1 499 589

Total income 1 159 331 86 268 22 278 20 873 5 14 352 875

1 084 833 678 624 710 060 54 052 43 765 1 955 134 1 541 360 671 453 508 768

Net claims incurred 593 214 582 461 312 279 353 738 25 600 17 790 1 189 513 2 566 000 (60 766) (167 835)

Acquisition costs 199 368 194 186 4 117 1 266 314 279 2 947 1 080 356 89

Interest allocated to cell owners - - - - - - - -

Employee benefit expense 71 659 61 931 - - - - - - - -

Management and other expenses - -

Total expenses 250 280 252 842 6 092 5 256 65 279 68 679 454 350 447 542

234 358 189 399 566 676 607 846 32 006 23 325 1 257 739 2 635 759 393 940 279 796

1 098 599 1 027 977

Net profit/(loss) before taxation 60 732 56 856 111 948 102 214 22 046 20 440 697 395 (1 094 399) 277 513 228 972

Taxation 21 355 13 902 32 885 28 692 5 351 5 641 187 630 (313 433) 209 723 185 053

Net profit/(loss) after taxation 39 377 42 954 79 063 73 522 509 765 (780 966)

Other comprehensive income/(expense) - - 16 695 14 799 (1 988) 67 790 43 919

Total comprehensive income/(loss) for the year - - 79 063 73 522 (3 752) 4 167 1 794 (782 954) 519 483 468 177

Transfer to/(from) retained earnings 39 377 42 954 - - 12 943 511 559 - 587 273 512 096

Other comprehensive (income)/expense - - 18 966 1 988 (912 035) 318 186

Dividends - - 55 000 (416) (1 430) - - (519 483) (468 177)

Change in retained earnings - - 150 000 18 522 3 752 (4 167) (1 794) (780 966)

50 000 19 435 (70 937) 7 500 - -

(10 623) 23 519 8 779 - - (844 245) 362 105

13 369 509 765

Net premium to gross premium 43% 50% 46% 46% 67% 68% 85% 79% 100% 100%

Claims incurred to earned premium 89% 84% 75% 81% 80% 56% 80% 222% (16%) (64%)

Management and other expenses to net earned 35% 27% 60% 58% 19% 17% 120% 169%

premium 4% 6%

Combined ratio 126% 121% 84% 88% 90% 65% 104% 106%

Operating ratio 97% 95% 78% 81% 32% 35% 83% 226% 31% 14%

Return on equity 20% 21% 41% 28% 18% 17% 53% 195% 2% 1%

36% (85%)