Page 110 - MC14326 all pages

P. 110

106 | The South African Insurance Industry Survey 2016

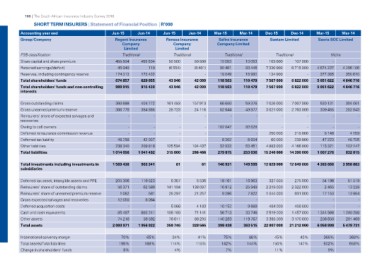

SHORT TERM INSURERS | Statement of Financial Position | R’000

Accounting year end Jun-15 Jun-14 Jun-15 Jun-14 Mar-15 Mar-14 Dec-15 Dec-14 Mar-15 Mar-14

Group/Company

Regent Insurance Renasa Insurance Safire Insurance Santam Limited Sasria SOC Limited

FSB classification Company Company Company Limited

Share capital and share premium Limited Limited

Retained earnings/(deficit)

Reserves, including contingency reserve Traditional Traditional Traditional Traditional Niche

Total shareholders' funds

Total shareholders' funds and non-controlling 455 504 455 504 50 500 50 500 10 053 10 053 103 000 107 000 --

interests

45 040 119 (6 554) (8 401) 90 461 83 446 7 330 000 6 715 000 4 674 237 4 296 106

174 313 173 432 -- 18 049 16 980 134 000 - 377 385 350 610

674 857 629 055 43 946 42 099 118 563 110 479 7 567 000 6 822 000 5 051 622 4 646 716

989 915 915 430 43 946 42 099 118 563 110 479 7 567 000 6 822 000 5 051 622 4 646 716

Gross outstanding claims 360 688 404 772 161 483 157 913 66 650 59 376 7 026 000 7 007 000 530 131 394 061

Gross unearned premium reserve 366 770 384 865 28 723 24 116 52 844 49 977 3 021 000 2 763 000 309 455 282 943

Reinsurers' share of expected salvages and - -

recoveries - - - - - - - -

Owing to cell owners - -

Deferred reinsurance commission revenue - - - - 102 047 83 628 - - - -

Deferred tax liability - - - - - - 250 000 215 000 5 146 4 159

Other liabilities 48 258 42 037 125 594 104 437 239 000 47 223 48 705

Total liabilities 238 340 209 818 315 800 286 466 6 302 6 604 60 000 4 166 000 115 321 102 147

1 014 056 1 041 492 52 032 53 451 4 883 000 14 390 000 1 007 276 832 015

279 875 253 036 15 240 000

Total investments including investments in 1 569 438 903 341 61 61 146 931 149 599 12 829 000 12 649 000 4 383 666 3 958 863

subsidiaries

Deferred tax asset, intangible assets and PPE 205 306 119 523 6 357 5 536 18 161 16 963 327 000 275 000 54 198 51 019

Reinsurers' share of outstanding claims 56 371 62 580 141 194 138 097 16 912 25 949 2 219 000 2 322 000 2 465 13 228

Reinsurers' share of unearned premium reserve 1 082 581 1 044 000 13 864

Gross expected salvages and recoveries 12 059 8 064 25 297 21 257 9 286 7 822 931 000 17 153

Deferred acquisition costs - - - - - - - - - -

Cash and cash equivalents 85 497 484 000 - -

Other assets 74 218 803 241 5 066 4 183 10 152 9 669 2 519 000 408 000 1 240 288

Total assets 59 592 105 160 71 141 56 713 33 746 3 385 000 1 457 000 1 344 566 201 469

2 003 971 88 290 140 283 119 767 22 807 000 3 170 000 256 850 5 478 731

1 956 922 76 611 328 565 398 438 363 515 21 212 000

359 746 6 058 898

International solvency margin 70% 65% 34% 41% 75% 86% 45% 43% 366% 368%

Total assets/Total liabilities 198% 188% 114% 115% 142% 144% 150% 147% 602% 658%

Change in shareholders' funds

8% 4% 7% 11% 9%