Page 111 - MC14326 all pages

P. 111

The South African Insurance Industry Survey 2016 | 107

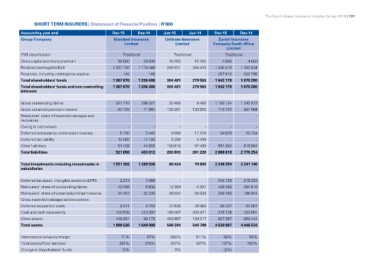

SHORT TERM INSURERS | Statement of Financial Position | R’000

Accounting year end Dec-15 Dec-14 Jun-15 Jun-14 Dec-15 Dec-14

Group/Company

Standard Insurance Unitrans Insurance Zurich Insurance

Limited Limited Company South Africa

Limited

FSB classification Traditional Traditional Traditional

Share capital and share premium

Retained earnings/(deficit) 30 000 30 000 15 150 15 150 4 650 4 650

Reserves, including contingency reserve

Total shareholders' funds 1 337 730 1 176 346 289 331 264 413 1 340 519 1 362 834

Total shareholders' funds and non-controlling

interests 140 140 -- 297 010 302 796

1 367 870 1 206 486 304 481 279 563 1 642 179 1 670 280

1 367 870 1 206 486 304 481 279 563 1 642 179 1 670 280

Gross outstanding claims 327 710 299 327 33 458 8 466 1 183 154 1 242 672

Gross unearned premium reserve 82 728 71 882 135 281 133 553 719 731 587 984

Reinsurers' share of expected salvages and - - - -

recoveries - -

Owing to cell owners - - - -

Deferred reinsurance commission revenue 5 705 5 445 - - 34 629 25 754

Deferred tax liability 14 080 12 103 9 089 17 219

Other liabilities 91 433 44 855 5 359 - -

Total liabilities 521 656 433 612 100 616 4 499 951 304 919 844

283 803 97 489 2 888 818 2 776 254

261 226

Total investments including investments in 1 551 393 1 280 566 86 424 79 805 2 246 354 2 241 146

subsidiaries

Deferred tax asset, intangible assets and PPE 2 273 1 068 - - 345 739 278 223

Reinsurers' share of outstanding claims 42 998 6 832 12 364 5 307 428 562 394 819

Reinsurers' share of unearned premium reserve 34 452 31 299 58 554 60 939 298 463 186 944

Gross expected salvages and recoveries

Deferred acquisition costs - - - - - -

Cash and cash equivalents 9 011 8 758 37 828 39 950 88 207 62 067

Other assets 100 538 213 397 189 207 200 471 315 705 432 891

Total assets 148 861 98 178 203 907 154 317 807 967 850 444

1 889 526 1 640 098 588 284 540 789 4 530 997 4 446 534

International solvency margin 71% 67% 390% 511% 58% 59%

Total assets/Total liabilities 362% 378% 207% 207% 157% 160%

Change in shareholders' funds

13% 9% (2%)